For additional information visit Income Tax for Individual Taxpayers Filing Information. Income Tax Return for Clubs and Other Organizations not Engaged in Business for Profit PDF 6656 KB Open PDF file 6057 KB for 2019 Form EFO.

Covid 19 Impact On Tax Returns And Certain Formalities Gide Loyrette Nouel

Complete Guide To Filing Your Personal Income Tax In 2019

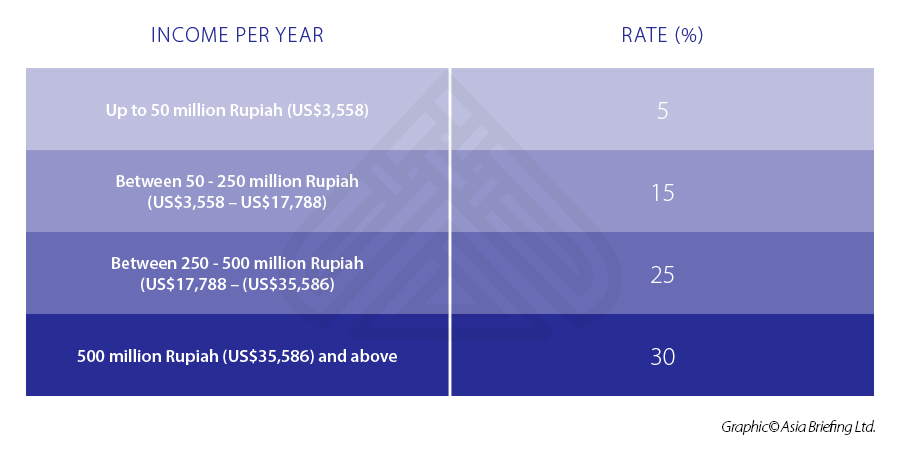

Personal Income Tax In Indonesia For Expatriate Workers Explained

Assessment Year 2020-21 at the following rates.

2019 income tax. PA-1 -- Online Use Tax Return. 2019 Individual Income Tax Forms. See State Tax Return Amendments.

Your DOB mmddyyyy SpousesRDPs DOB mmddyyyy Your prior name see instructions SpousesRDPs prior name see instructions Single. DEX 93 -- Personal Income Tax Correspondence Sheet. If your California filing status is different from your federal filing status check.

February 19 2020. 2019 Form 1040N Nebraska Individual Income Tax Return. The income tax slab under which an individual falls is determined based on the income earned by an individual.

2019 Federal Income Tax Forms Printable 2019 federal income tax forms 1040 1040SS 1040PR 1040NR 1040X instructions schedules and more. For fill-in forms to work properly with the bank you must have free Adobe Reader software on your computer. 80024 2312 Rev.

Use this form to file your 2019 Business Income Receipts Tax BIRT. Excel based Income Tax Calculator for FY 2019-20 AY 2020-21. Income Tax Brackets and Rates.

The most recent state as of 2019 to enact a personal income tax was New Jersey in 1976. Access 2019 state income tax return forms and schedules. 2019 Nebraska Public High School District Codes.

Based on the age of an individual the resident taxpayers are divided into three categories. Printable 2019 federal tax forms are listed below along with their most commonly filed supporting IRS schedules worksheets 2019 tax tables and instructions for easy one page access. 2019 Individual Income Tax Forms Content_Area1 Note.

PDF 56234 KB - December 17 2019 Individual Income Tax. 2019 Form 1040N Conversion Chart for. 2019 D-400 Individual Income Tax Return.

2019 Virginia Resident Form 760 Individual Income Tax Return Keywords. In Maine Massachusetts Montana Nebraska Oregon and Wisconsin state withholding also applies to individuals required to file a state tax return in that state. The instruction booklets listed here do not include forms.

Use this form to file 2019 Business Income Receipts Tax BIRT if 100 of your business was conducted in Philadelphia. Sl No Total Income Rate of tax. Fiduciary Estate.

Complete this version using your computer to enter the required information. DPO-86 -- File Your PA Personal Income Tax Return Online For Free With myPATH. Amended Return Return is due April 15 2020.

The first state to enact a personal income tax was Wisconsin in 1911. TAX RATE The state income tax rate for 2019 is 307 percent 00307. The individuals whose income is less than Rs25 lakh per annum are exempted from tax.

Filers First Name. PA-19 -- PA Schedule 19 - Taxable Sale of a Principal Residence. 2019 Nebraska Tax Table.

122019 2019 Ascensus LLC STATE INCOME TAX WITHHOLDING RULES GENERAL RULES In most cases state withholding applies to state residents only. The other 43 states collected an income tax in addition to the federal income tax. As per the Finance No2 Act 2019 income-tax is required to be deducted under Section 192 of the Act from income chargeable under the head Salaries for the financial year 2019-20 ie.

Basic overview of Tax Year 2019 for families and individuals. IL-1040-ES 2020 Estimated Income Tax Payments for Individuals Use this form for payments that are due on April 15 2020 June 15. 123-45-6789 If a Joint Return Spouses First Name.

Obamas approach in 2013. The top marginal income tax rate of 37 percent will hit taxpayers with taxable income of 510300 and higher for single filers and 612350 and higher for married couples filing jointly. 21 Rates of tax A.

2019 Individual Income Tax Booklet with forms tables instructions and additional information. Include Schedule AMD 1. This excel-based Income tax calculator can be used for computing income tax on income from salary pension gifts fixed deposit and bank interest house rent and capital gains short and long term gains.

Type or print in blue or black ink. 2018 Income Tax Forms Its a no-charge electronic tax filing option. Amended Individual Income Tax Return.

Virginia Resident Individual Income Tax Return Created Date. Average income tax per household in the UK in 201920 by decile group Individual income tax rate in Belgium 2009-2019 Average tax cuts under GOP approach vs. 2019 BIRT Schedules for H-J filers PDF.

2019 TAX RETURN FILING DUE DATE To remain consistent with the federal tax due date the due date for filing 2019 Pennsylvania tax returns will be on or before midnight Wednesday April 15 2020. Filers Full Social Security No. 2019 Income Tax Forms Corporation.

Individual Income Tax Return. DFO-02 -- Personal Individual Tax Preparation Guide - For Personal Income Tax Returns PA-40. Income Tax Slab for Financial Year 2019-20.

California Resident Income Tax Return. Open PDF file 6656 KB for 2019 Form 3M. Forms are available for downloading in the Resident Individuals Income.

Amend or change an accepted IRS Tax Return by completing a IRS Tax Amendment. This measure will reduce Income Tax for 306 million Income Tax payers in 2019 to 2020 307 million in 2020 to 2021 including low and middle income individuals improving incentives to. Normal Rates of tax.

Access IRS back tax previous year calculators tax forms and tools. Then print and file the form. 2019 Form 1040N Schedules I II and III.

2019 Personal Income Tax Forms. Personal Income Tax Declaration of Paper Filing PDF 6057 KB Open PDF. For taxable years beginning on or after January 1 2019 the refundable Young Child Tax Credit YCTC is available to taxpayers who also qualify for the California Earned Income Tax Credit EITC and who have at least one qualifying child who is younger than six years old as of the last day of the taxable year.

2019 MICHIGAN Individual Income Tax Return MI-1040. 1152020 31400 PM. Hawaii enacted an income tax in 1901 which was before Wisconsin but Hawaii was not a state until 1959.

In 2019 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows Tables 1.

Income Tax Brackets For 2019 Increased Due To Inflation

Income Tax Slab For Ay 2020 21

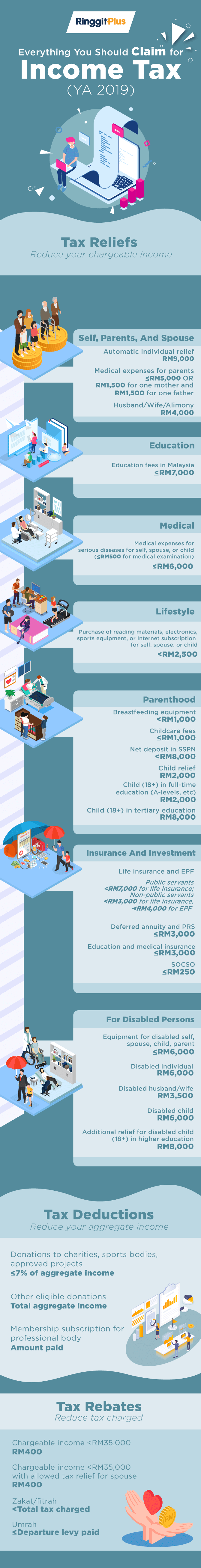

10 Things To Know For Filing Income Tax In 2019 Mypf My

China Personal Income Tax Rate 2021 Data 2022 Forecast 2003 2020 Historical

What Was Your Income Tax For 2019 Federal Student Aid

Alexandria Ocasio Cortez S Tax Plan How Us Progressive Tax Works

Iras Annual Report Fy2018 19 Tax Revenue Collection Up 4 4 A Digital Iras For A Taxpayer Centred Experience

Malaysia Personal Income Tax Guide 2020 Ya 2019

- 霸 凌 英文

- Princess Hours Cast

- undefined

- How To Handle A Stubborn Child

- Childrens Hospital Show

- Model Rambut Pendek Sesuai Bentuk Wajah

- Nahu Bahasa Arab

- Zarina Zainuddin Dan Suami

- Does Turmeric Cause Insomnia

- Hilang Yang Kembali Episod 12

- Kelebihan Membaca Buku

- Kelebihan Surah Al Hasyr Ayat 21 24

- Kaneki Black Hair

- Ps4 Near Me

- Resepi Ikan Tiga Rasa Ala Thai

- Tegar Aku Yang Dulu

- Bendera Perak Berkibar

- Where Is Astrazeneca Vaccine Made

- Novel Bahasa Inggeris

- Ap Boom Mercun