But they have some key differences in. When youre choosing mutual funds make sure to look for and invest in funds that have good track recordsmeaning that you can see proven long-term growth in the stock market.

Mutual Funds Vs Etfs Top 7 Differences With Infographics

Etf Vs Mutual Fund Ramseysolutions Com

Etfs From Creation To Trading Finance Magnates

Mutual Fund To ETF Converter is designed to facilitate the switch from mutual funds to ETFs.

Etf vs mutual fund. ETF Databases proprietary mapping system will identify the best. Mutual Fund It Depends on Your Strategy. Both VFIAX a mutual fund and SPY an ETF seek to track the SP 500.

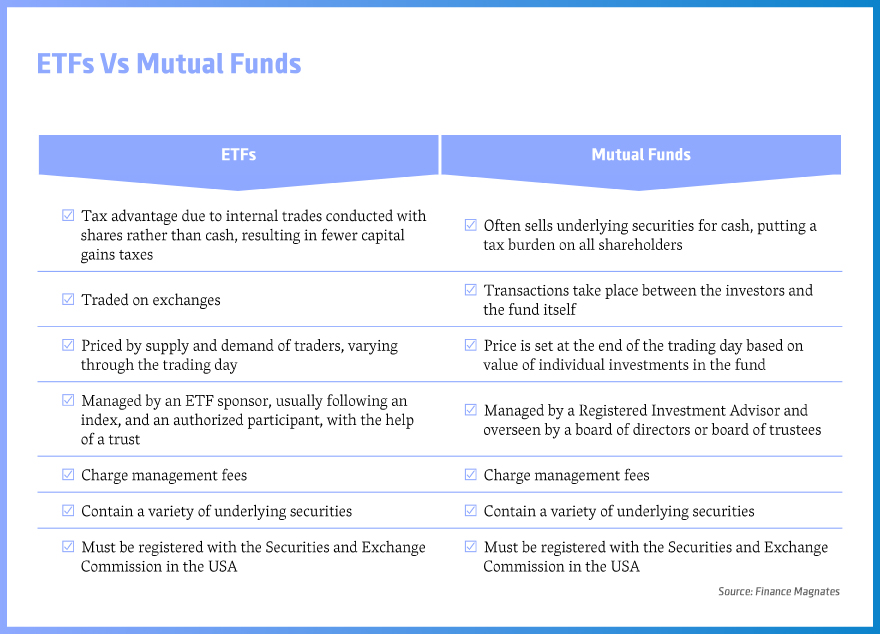

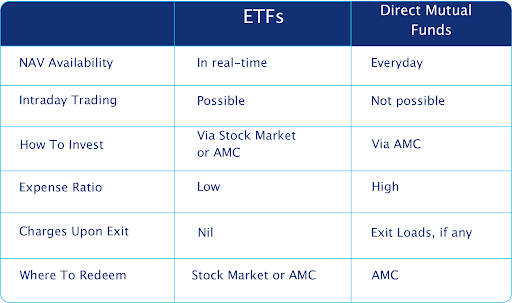

For example unlike with a traditional open-ended mutual fund the price of an ETF is set throughout the day. Exchange-traded funds ETFs index mutual funds and actively managed mutual funds can provide broad diversified exposure to an asset class region or specific market niche without having to. Mutual funds and exchange-traded funds ETFs have a lot in common.

For starters with a mutual fund you often buy and sell shares directly with the fund company. Mirae Asset Mutual Fund announced the launch of the Mirae Asset Hang Seng TECH ETF an open-ended scheme replicatingtracking the Hang Seng TECH Total Return Index as. While an index fund is attempting to track a specific index an actively managed fund employs a professional fund manager to hand-select the specific bonds or stocks that will be included in the fund in an attempt to outperform an index.

Investors looking for diversification often turn to the world of funds. On the one hand there are traditional index mutual funds like the Vanguard 500 Index Fund. Mutual Fund To ETF Converter is designed to facilitate the switch from mutual funds to ETFs.

What to Know Before Investing Mutual funds and ETFs offer investors similar advantages but there are a few key differences. Exchange traded funds have been well established to often be more tax-efficient vehicles than their mutual fund counterparts and the recent trend of creating actively managed ETF versions of. Get answers to common ETF questions.

While fees vary the average equity mutual fund management fee is about 140. Which Is The Better Investment. An ETF or a mutual fund that attempts to beat the marketor more specifically to outperform the funds benchmark.

What Is an ETF Exchange-Traded Fund. Theyre similar in a lot of ways and the terms are used interchangeably by some but index funds typically refer to indexed mutual funds while ETFs can refer to any type of ETF without regard to its holdings goals or fee structure. Higher demand from investors can result in the shares trading at a premium compared to the value of the stocks that the ETF holds and falling demand could cause the ETF to trade at a discount compared to the value of the ETFs holdings.

The funds Peer Rank reflects the ranking of a funds MSCI ESG Fund Quality Score against the scores of other funds within the same peer group as defined by the Thomson Reuters Lipper Global. The primary differences between the two are that SPY has a smaller expense ratio and that the. Todd Rosenbluth CFRA Head of ETF and Mutual Fund Research joins Yahoo Finance to discuss the new Bitcoin Futures ETF potential shakeup to.

ETF Databases proprietary mapping system will identify the best. Arielle OShea Nov 3 2021. Then there are so-called exchange-traded funds such as the SPDR SP 500 ETF.

Most ETFs track market indexes whereas mutual funds are more likely to be actively managed. Just like their name suggests ETFs are funds that are traded on a stock market exchange. Both will give you similar results but they are structured somewhat differently.

See how 9 model portfolios have performed in the past. Both types of funds consist of a mix of many different assets and represent a. Active management can be a good thing if the fund manager is talented and is able to outperform the market.

The funds Peer Rank reflects the ranking of a funds MSCI ESG Fund Quality Score against the scores of other funds within the same peer group as defined by the Thomson Reuters Lipper Global. Learn how to analyse which mutual fund is a better investment. Posted by Iain Butler TMFOHCanada Last Updated March 3 2021 EST October 5 2021 EDT.

This is a comparison of VFIAX vs VTSAX. Mutual Fund vs. Vanguard 500 Index Fund VFIAX seeks to track the performance of a benchmark index that measures the investment return of large-capitalization stocks.

Vanguard Total Stock Market Index Fund VTSAX seeks to track the performance of a benchmark index that measures the investment return of. Theyre basically a cross between mutual funds and stocks. The money collected from various investors is usually invested in financial securities like shares and money-market instruments like certificate of deposit and bonds.

ETF vs Mutual Fund. Mutual funds and exchange-traded funds ETF can both offer many benefits for your portfolio including instant diversification at a low cost. There are strengths weaknesses and best-use strategies for both index funds and exchange-traded funds ETFs.

A Mutual Fund is an investment scheme that collects money from people and invests those funds in various assets.

Etf Vs Mutual Fund What S The Difference Ally

Etf Vs Mutual Funds Overview Similarities Differences

Advantages And Disadvantages Of Etfs Versus Mutual Funds Red River Trade

Etf Vs Mutual Fund A Simple And Complete Comparison By Etf Europe Etfeurope Research Hub Medium

Etf Vs Mutual Funds Comparison Adessonews Adessonews Adesso News Retefin Retefin Finanziamenti Agevolazioni Norme E Tributi

Investplex Etf Portfolio Management Tool About

How Do Exchange Traded Funds Work Unbrick Id

Etfs Vs Actively Managed Mutual Funds And The Popularity Of Index Investing Global X Etfs