Mortgage rates valid as of 08 Nov 2021 1017 am. Fixed Rate Mortgage Loans and Rates Consistent payments for the life of your loan.

Mortgage Rates On 30 Year Home Loan Hit 5 Percent

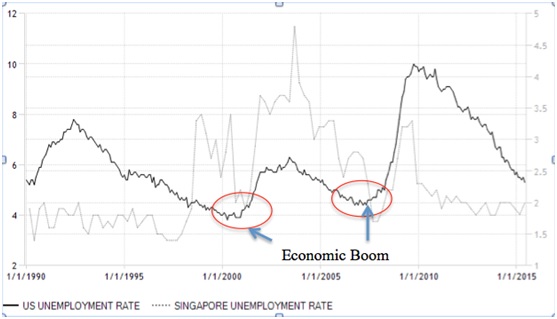

Singapore Mortgage Interest Rate Trends

Should You Pay Off Your Mortgage Early With Rates So Low

While 30-year mortgage rates change current national average 30-year fixed rates hover between 275 and 375.

Fixed rate mortgage rates. 11 rate of 269 todays homebuyers would be paying an extra 112 in monthly mortgage payments translating into about 10549 extra. A fixed rate mortgage has a rate of interest which doesnt change for a set period of time so you know exactly how much you pay every month. If youre looking for a home loan where the monthly payment will not change providing the ability to.

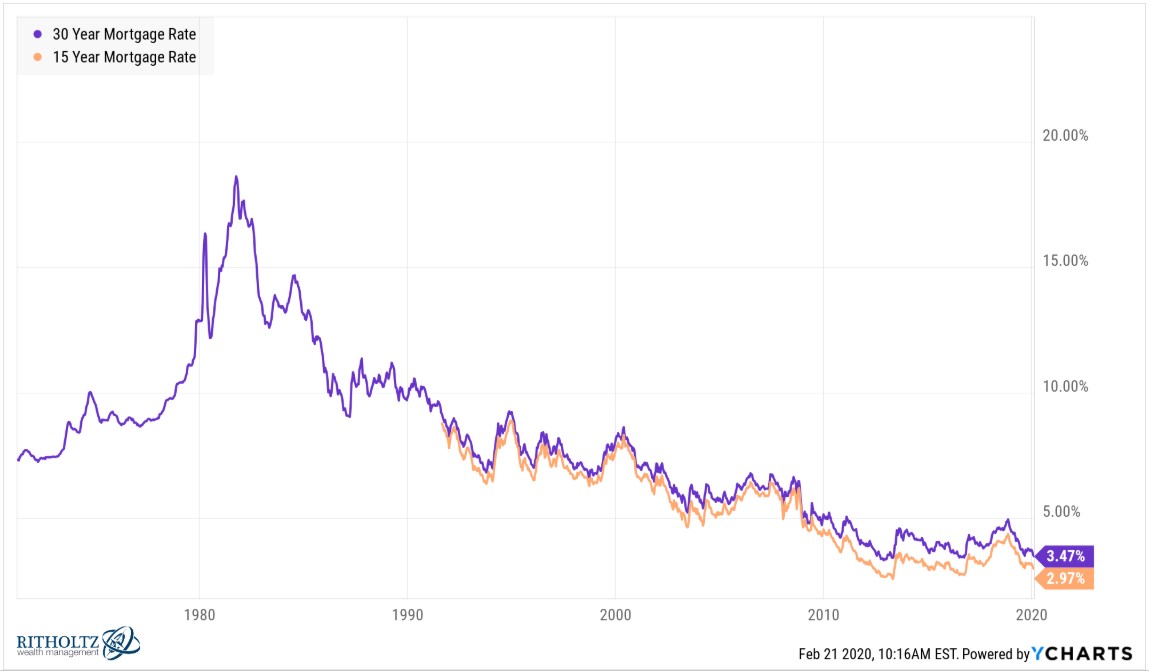

Mortgage rates were in the double-digits for 30-year fixed-rate home loans. See the 30-year fixed mortgage rates today how 30-year loans work. Given that ARM loans are variable the interest rate could end up being higher than with a 30-year fixed rate mortgage that has a locked-in mortgage rate.

View data of the average interest rate calculated weekly of fixed-rate mortgages with a 30-year repayment term. The mortgage interest rate is consistent for the life of the loan compared to an adjustable-rate mortgage that changes over the course of the loan. Estimated monthly payments shown include principal interest and if applicable any required mortgage insurance.

Since then mortgage rates have fallen substantially as rates havent climbed higher than 10 since 1990. For today Tuesday November 23 2021 the average APR for a 30-year fixed mortgage is 332 down 3 basis. Additional Charts-30 Year Fixed Rate Mortgage 1971-present Read Our Latest Daily Rate Update Nov 23 2021 446PM.

A fixed-rate mortgage could suit you if you want to know what your payments will be each month. Compare all fixed mortgages here. The combination of rising inflation and consumer spending is driving mortgage rates higher.

The lowest fixed rate Conventional mortgages may offer a lower interest rate and Annual Percentage Rate APR than other types of fixed-rate loans. Borrowers typically seek to lock in lower rates of interest to save money over time. After 2 years from the point you receive the mortgage you would move onto the lenders standard variable rate SVR unless you switch to a new deal with the same lender or remortgage to a new lender.

A 2 year fixed rate means your monthly payment will remain the same for 2 years. Choose from a range of fixed-rate mortgages and apply now. With 10-year fixed rates being rare you may want to start a search for a fixed rate loan looking at 3-year fixed rates 4-year fixed rates or the more standard maximum length 5-year fixed rate loans.

The fixed-rate mortgage was the first mortgage loan that was fully amortized fully paid at the end of the loan precluding successive loans and had fixed interest rates and payments. Throughout 2020 however mortgage rates saw a steep drop that followed the COVID-19 outbreak. When interest rates rise a fixed-rate mortgage will have lower risk for a borrower and higher risk for a lender.

Fixed-rate mortgages are the most classic form of loan for home and product purchasing in the United States. 30 Year Fixed Mortgage Rate - Historical Chart. These rates are sourced from the Bank of Canada which sources its data from posted bank rates.

Posted Historical 5-Year Fixed Mortgage Rates 1973 - 2010 The 5-year fixed mortgage rate is the most popular rate in Canada. But remember its fixed for a certain time like three five or seven years and if you change it before the end we may charge you a fee. At the end of the 2 year period you will be able to remortgage or move home without paying an early.

View historical values for posted rates as far back as 1973. Once the fixed rate term ends your home loan will generally switch to the lenders standard variable rate. According to FreddieMac a typical mortgage rate for a 15-year fixed loan in 2019 came with a 35 interest rate down a half percentage point from the year before.

Fixed rate mortgages offer the security of knowing how much you will pay each month for a set period like 2 3 5 or 10 years even if other mortgage rates go up. With a fixed-rate mortgage or a conventional loan the interest rate wont change for the life of your loan protecting you from the possibility of rising interest rates. ARM interest rates and payments are subject to increase after the initial fixed-rate period 5 years for a 5y6m ARM 7 years for a 7y6m ARM.

1 rate of 219 and a Nov. EST and assume borrower has excellent credit including a credit score of 740 or higher. The current 30 year mortgage fixed rate as of November 2021 is 310.

Todays national mortgage rate trends. With a fixed-rate refinance loan your monthly principal and interest payment stay the same for the entire loan term. A 15-year fixed rate mortgage on the other hand may offer a lower interest rate that wont fluctuate like an ARM loan but requires a higher monthly payment compared to a 30-year fixed rate mortgage.

The main advantage of a fixed-rate loan is that the borrower is protected from sudden and potentially significant increases in monthly mortgage payments if interest rates rise. Mortgage Rates Tick Up November 18 2021. Shoppers looking to buy a home are fueling strong demand while ongoing inventory shortages are not improving in the presence of higher home prices.

A fixed rate mortgage is a reliable option because it offers predictable monthly payments. Learn more about different types of mortgage rates and call 1-866-351-5353 for current mortgage rates. Interactive historical chart showing the 30 year fixed rate mortgage average in the United States since 1971.

According to data from Freddie Mac annual mortgage rates averaged as high as 1663 in 1981. A fixed rate makes it easier to budget for payments. Rates subject to change.

View rates and refinance to a loan that offers consistent monthly payments. Based on the average new mortgage amount of 450000 according to CIBC and an assumed Oct.

30 Year Fixed Mortgage Rate Historical Chart Macrotrends

With Mortgage Rates So Low Is Now A Good Time To Refinance

The Average Adjustable Rate Mortgage Is Nearly 700 000 Here S What That Tells Us Marketwatch

Cost Of Five Year Fixed Rate Mortgages Falls On Global Outlook

Higher Interest Rates Mean More Expensive Mortgages The Economist

Mortgage Rates Flat But Data Points To Changes Ahead National Mortgage News

Fixed Rate Mortgages Easy To Understand But Are They A Good Deal

Best Home Mortgage Loans In Singapore 2021 Valuechampion Singapore